Insulin: a case study for why we need a public option in the pharmaceutical industry

STAT | September 10, 2019

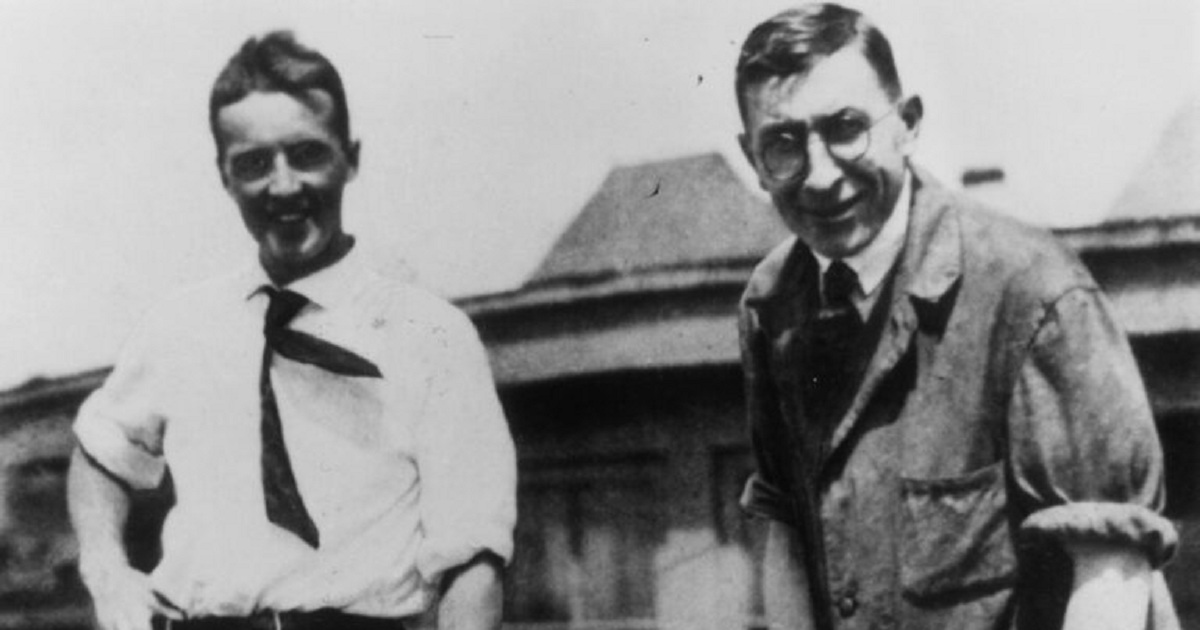

When Frederick Banting, Charles Best, and James Collip filed for a U.S. patent on insulin in 1923 and sold it to the University of Toronto for $1 each, they did it because, as Best once said, “insulin belongs to the world.” They also believed that securing the patent was a form of publication, and wrote to the university president, “When the details of the method of preparation are published anyone would be free to prepare the extract, but no one could secure a profitable monopoly.” Sadly, they were mistaken. Today, three companies — Eli Lilly, Novo Nordisk (NVO), and Sanofi (SNY) Aventis — control virtually the entire global market for insulin. This oligopoly, which may have colluded to fix insulin prices, charges exorbitant amounts for a medicine that people with type 1 diabetes cannot live without. Since the 1990s, they have raised the price of insulin more than 1,200%. In the past few years we’ve learned about the tragic and preventable deaths of 20-somethings who simply couldn’t afford their insulin, even with insurance. Diabetes-related complications like amputations are on the rise again after decades of decline, and many people who depend on insulin to survive are sacrificing their rent, their cars, and their dignity just to get by.