ViiV unveils emotional challenges related to HIV ART treatment

Pharmaceutical Technology | October 04, 2019

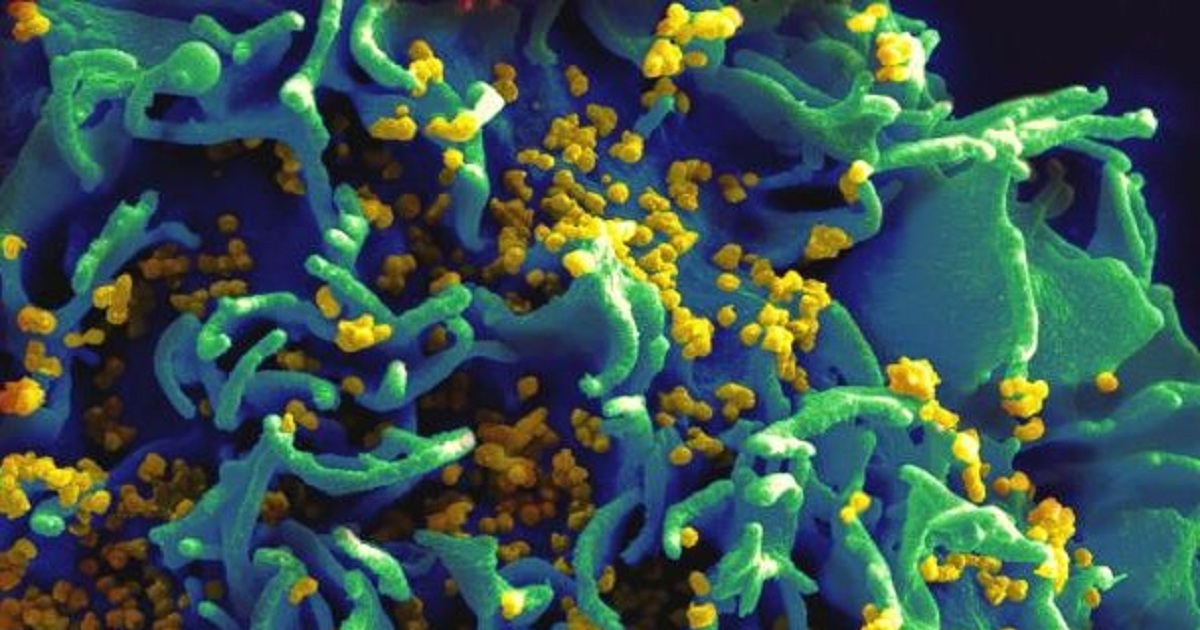

GSK’s ViiV Healthcare has presented results from its Positive Perspectives study examining the emotional challenges and burden of human immunodeficiency virus (HIV) antiretroviral therapy (ART) on people living with the condition. The study found that despite 87% of participants currently in treatment being satisfied with their present ART, there are still emotional challenges associated with the daily regimen of ART, with 66% saying taking daily ART was a constant reminder of their HIV status. Emotional challenges were particularly noteworthy for younger patients and those recently diagnosed. These groups reported more frequent concealment of medications – only 37% of the general group reported frequent concealing of medication, compared to 52% of both younger patients and those recently diagnosed. Younger patients and recently diagnosed patients also reported heightened stress and pressure from taking medications at the right time every day. The Positive Perspectives study recorded 30% of the general survey respondents felt stress and pressure from taking HIV medication at the right time every day, this figure grew to 37% for younger patients and 41% of those who were recently diagnosed with HIV.